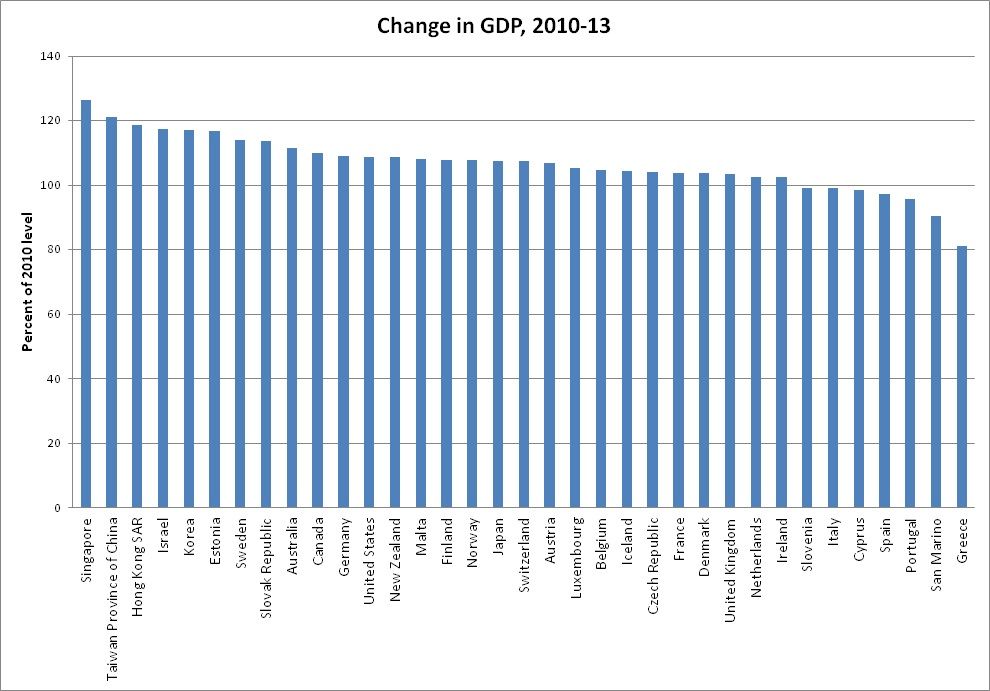

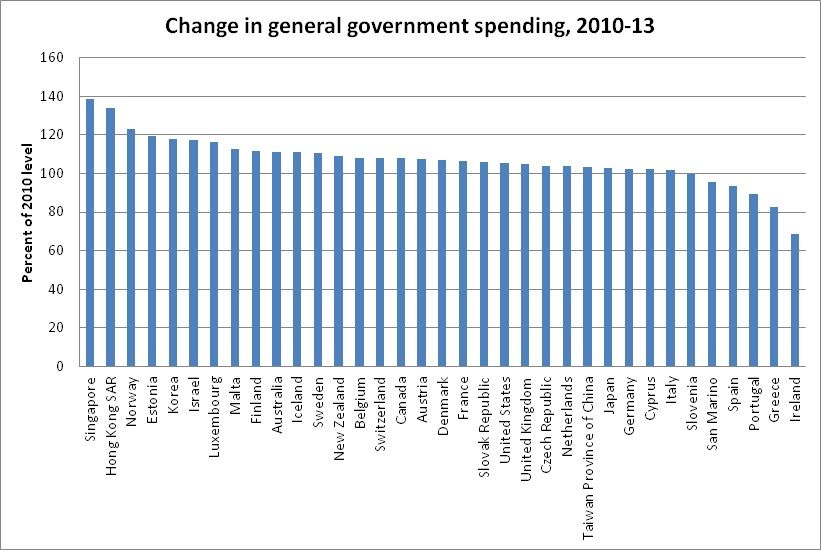

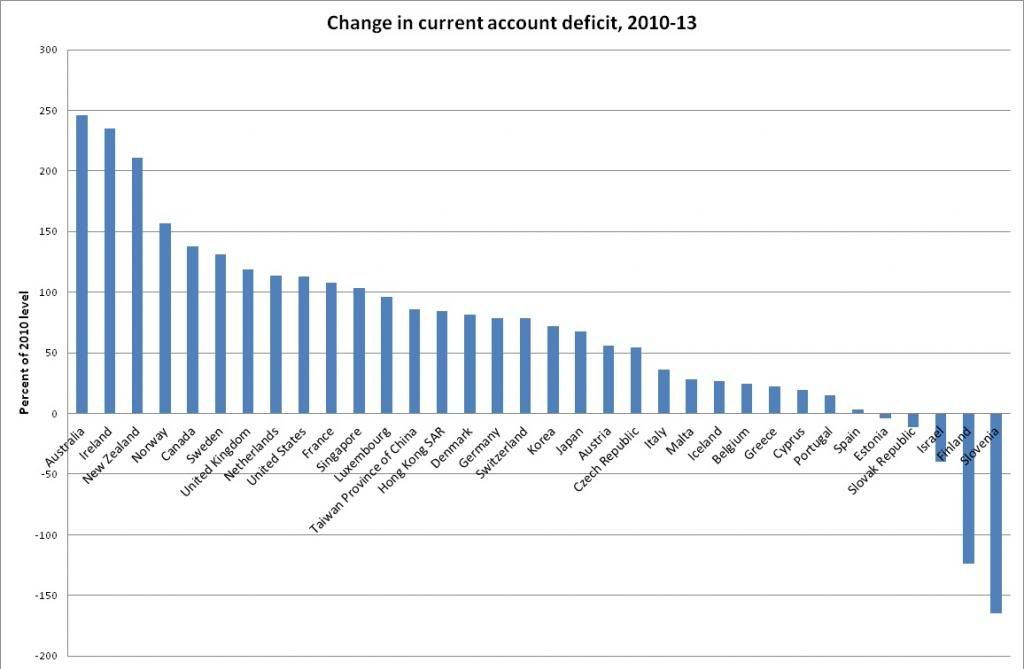

The chart entries are ordered by increase in the graphed variable. The high growth countries are presented at the top of the growth chart, the high spending increase countries are presented to the left of the spending chart. The countries with the most net capital imports growth are to the left of the current account chart.

The most obvious conclusions from these rankings is that they almost mirror each other. Countries with more rapid spending growth experienced more rapid economic growth. The peripheral European countries forced to lend at unfavorable interest rates are expelling capital. This process sustains low interest rates to maintain growth among the rest of the advanced economies.

Overall GDP in the Eurozone has grown less than 1% a year despite the significant changes in GDP and spending among its member states. Likewise, an economic recovery would tend to increase capital costs and interest rates, yet the LIBOR increased barely a tenth of a percentage point over this period.

This reveals the ultimate unsustainability of the "economic stimulus" policies pushed by many liberal economists. Debt growth does not, in fact, create significant net growth for the advanced economies. Rather, its primary effect is to shift lending between countries and increase existing flows of interest payments. Nations with low bond yields can afford rapid spending growth and economic growth. "Crisis" nations are in fact in crisis because they are forced to lend at unfavorable rates to countries in better economic conditions, exacerbating the divide between high- and low-performance groups among the advanced economies.

Krugman claims that overall spending growth is not an accurate indicator of stimulus because consumption is more effective stimulus than transfers. He correctly observes that most spending growth has been driven by unemployment insurance, welfare and other "ineffective" stimulus, and as a result the lowest-spending countries are actually the ones avoiding austerity because they are primarily spending on government consumption. He then offers a theoretical argument that government consumption purchases are spent more rapidly than transfers to households. But this statement, like Krugman's existence, is unwarranted.

The empirical evidence unanimously shows that transfer spending has, if anything, a much higher multiplier than government consumption. Transfers tend to flow to low income groups, which currently have the lowest savings rates. Thus government consumption, spending on infrastructure projects, corporate solar investment subsidies and the like, is not as progressive as transfer spending. Krugman shows his true liberal colors by preferring government consumption spending to health and welfare transfers to low income households despite all evidence showing the latter is more effective stimulus, and cross-country differences in spending growth could amplify over time.

Ultimately, though, both types of spending are temporary fixes to the fundamental problems of markets. Rather than create net growth, debt raises the return on investment in high-spending countries, drawing capital out of low-spending countries and worsening their economic paralysis. The divide between the "austerity" and "stimulus" outcomes is not some temporary phenomenon that can be resolved by the robust economies continuing to borrow at low interest and the perhiphery getting itself further into debt and further widening their bond spreads. Rather, it is a fundamental feature of the global capitalist economy which deficit spending only exacerbates.

Edited by mustang19 ()

I'm telling rHizzone to abolish all rent and interest because it's the most politically active forum on the net.

[citation needed]

Edited by mustang19 ()

mustang19 posted:IMF data. All graphs in current USD, except spending is LCU.

he's talking about the idea that anyone on the 'zzone is politically active.

A: Abandon incrementalism and implement the communist programme.

mustang19 posted:I can't believe the multicultural fascists deleted my islam threads.

mustang19 posted:Why is Krugman famous? Is it that he's good at explaining economics at the level of an retard?

did you see this one?

http://krugman.blogs.nytimes.com/2012/12/08/rise-of-the-robots/

I think our eyes have been averted from the capital/labor dimension of inequality, for several reasons. It didn’t seem crucial back in the 1990s, and not enough people (me included!) have looked up to notice that things have changed. It has echoes of old-fashioned Marxism — which shouldn’t be a reason to ignore facts, but too often is. And it has really uncomfortable implications.

Edited by mustang19 ()

mustang19 posted:Why is Krugman famous? Is it that he's good at explaining economics at the level of an retard?

yes basically

Doug posted:he was an actual economist who got economist famous for work on currency then wrote columns for nyt and stuff and he's typical left neo-liberal who likes free trade and the right sort of technocratic reforms but less military spending and called galbraith a poopy head

thank u

Doug posted:http://www.uq.edu.au/economics/abstract/369.pdf<<<-------------- if you want to read pdf about how krugman is a poopy head

The Nobel Prize really destroyed economics, it created all these cults of personal drama. It's like namefagging on an imageboard.

Doug posted:http://www.uq.edu.au/economics/abstract/369.pdf<<<-------------- if you want to read pdf about how krugman is a poopy head

now, do you know anything about trotskyism

Trotskyist Noam Chomsky denying GW is a liberal hoax.

libertarian discovers 1 simple crypto-currency trick to erase government. adam smith HATES her.

Also expending real resources to create currency = most retared idea ever, the guy has a point there.